Common Tax Deductions for Travel Nurses in 2025

I’ve had this same conversation more times than I can count. We’re sitting across from each other, sometimes literally over coffee, sometimes over Zoom, and you say something like, “I make good money, but my taxes still feel weird. Am I missing deductions?”

Short answer? Maybe.

Longer answer? It depends!

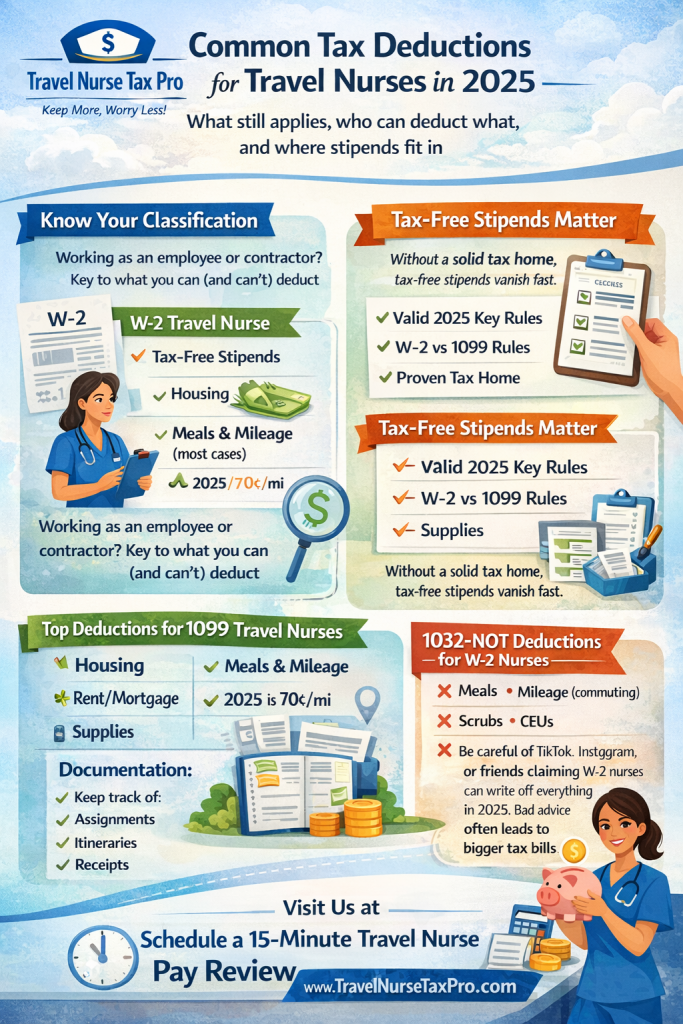

It depends heavily on how you’re paid and whether you’re working as a W-2 travel nurse or a 1099 contractor. That’s where most of the confusion starts.

Travel nurse tax deductions in 2025 don’t work the way they used to. Some deductions are gone. Others still matter, but only in specific situations. And for most travel nurses, the biggest tax benefit doesn’t even show up as a deduction on the return – it’s your tax-free stipend.

Let’s talk it through like real people. No fluff. No IRS-speak unless we have to. Just what actually applies for 2025 and what you need to understand going into 2026.

How Tax-Free Stipends Work (and Why They’re the Biggest Tax Benefit for Travel Nurses)

If you’re a W2 travel nurse, this is where the real money is.

Tax-free stipends, housing, meals and incidentals (M&IE), and sometimes travel reimbursements, can often result in a travel nurse earning more money on an after-tax basis than most staff nurses making similar gross pay.

When structured correctly, these won’t even show up as taxable income. This is where the distinction between tax-free stipends vs deductions really matters.

A deduction reduces income after it’s already taxable.

A stipend avoids tax before it ever hits your return.

“Understanding the difference between a deduction that reduces taxable income and a stipend that avoids tax is critical to maximizing your financial health! When properly earned, Tax-free stipends are powerful, and getting them right matters” said Jeffrey Barth, CPA fromTravel Nurse Tax Pro.

But, and this is a big but, stipends are only tax-free if you have a valid tax home. In practical terms, that usually means:

- You maintain a regular residence with ongoing expenses

- You work temporary assignments away from that home

- You don’t abandon that home while chasing contracts

If your tax home falls apart, those stipends can flip from tax-free to fully taxable very quickly. And yes, the IRS has been paying closer attention to this. This also answers one of the most common questions we hear every year:

Can travel nurses deduct unreimbursed meals, mileage,

or housing, if they’re W-2 employees in 2025?

In almost all cases the answer is, No.

Unreimbursed employee expenses were suspended under the Tax Cuts and Jobs Act, and IRS Publication 463 spells that out clearly. Even if you paid those costs out of pocket, they don’t get deducted on Schedule A anymore.

And here’s an important update going into 2026: the One Big Beautiful Bill Act (OBBBA), passed in 2025, made this suspension permanent. That means unreimbursed employee expenses like meals, mileage, or housing are not coming back for W-2 travel nurses.

That’s exactly why stipends matter so much. When done correctly, they replace deductions that no longer exist.

👉 Schedule a 15-Minute Stipend Review

Unreimbursed Expenses That May Qualify as Deductions for 1099 Travel Nurses

Now, if you’re working as a 1099 travel nurse, or you have a side assignment structured that way, the rules change.

Schedule C is a different animal. Business expenses are still deductible, and this is where many traditional travel nurse tax deductions in 2025 still have real teeth.

Depending on your situation, deductible expenses for 1099 travel nurses may include:

- Housing costs while working away from your tax home

- Business mileage between job sites

- Meals while traveling overnight for work (generally 50 percent)

- Supplies and other ordinary, necessary job-related costs

As an independent-contractor, you’re treated as a business. The IRS expects you to subtract expenses before calculating taxable profit. But here’s where people get tripped up.

You can’t call yourself a contractor for deductions and act like an employee everywhere else. Misclassification is one of the fastest ways to invite IRS scrutiny. We see this every year: a nurse is paid on a 1099, deducts everything under the sun, but works full-time under hospital control with no real independence. That’s a problem.

Yes, 1099 travel nurses have more options. Just make sure the classification actually holds water. And, don’t fall for those instagram scams that say if you start an LLC you can write off everything and pay no taxes. It’s a recipe for disaster.

Professional Expenses: CEUs, Licenses, Certifications, and Uniforms

This answer surprises a lot of nurses.

If you’re a W-2 travel nurse in 2025, professional expenses usually aren’t deductible. Scrubs, CEUs, license renewals, certifications — all of it falls under unreimbursed employee expenses, which remain suspended.

So when someone asks, “What professional expenses like scrubs, CEUs, or licenses can most travel nurses deduct?” The answer is: it depends on how you’re paid.

For 1099 travel nurses, many of these costs can qualify as ordinary and necessary business expenses, including:

- Continuing education that maintains or improves current skills

- State license renewals tied to contracts

- Certification fees directly related to your work

- Uniforms and scrubs not suitable for everyday wear

IRS Publication 463 and related guidance are clear on this point. Education must maintain or improve skills in your current profession. It can’t qualify you for a brand-new line of work.

For W-2 nurses, reimbursement is usually the better play. If your agency offers education or license reimbursements, that’s the tax-friendly route. Trying to force deductions that no longer exist usually backfires.

And a quick warning here. If you see a TikTok, Instagram post, or hear from a friend who “set up an LLC and writes everything off so they pay zero taxes,” hoist the red flag. We’ve seen plenty of nurses fall for this, and it usually ends with more tax, penalties, interest, and stress, not less.

Mileage and Vehicle Costs Using the 2025 IRS Standard Rate

Mileage is another area full of half-truths.

The 2025 IRS standard mileage rate is 70 cents per mile, which is generous. But not everyone can use it.

If you’re a 1099 travel nurse, qualifying business mileage can be deductible. That may include driving between facilities, required meetings, or temporary job sites while traveling away from your tax home.

If you’re a W-2 travel nurse, your mileage deduction options are extremely limited. Commuting miles don’t count and unreimbursed mileage is still suspended.

So when someone asks, “How does the 2025 standard mileage rate work for travel nurses who drive for work?” the real question is always: employee or contractor?

Documentation matters here more than almost anywhere else. The IRS doesn’t accept estimates. You need:

- Dates

- Purpose of the trip

- Starting and ending locations

- Total miles driven

Apps help. Logs help. Memory doesn’t.

One more thing: if your agency reimburses mileage under an accountable plan, that reimbursement is usually tax-free. That’s often better than trying to deduct it later.

Why Documentation Matters and Red Flags That Limit Deductions

This is where our friendly chat turns serious for a moment.

The IRS doesn’t deny deductions because they hate travel nurses. They deny them because documentation is sloppy, inconsistent, or nonexistent.

Common red flags we see include:

- Mileage claimed with no logs, just round numbers

- Housing deductions without a valid tax home

- W-2 nurses claiming Schedule C-style expenses

- Years of zero expenses followed by sudden “everything deducted”

- Education expenses that qualify you for a new specialty, not your current role

IRS Publication 463 outlines recordkeeping expectations, and examiners actually use it.

A good rule of thumb: if someone else looked at your return, could they follow the story without you explaining it? If the answer is no, deductions get limited fast.

Final Thoughts

Travel nurse tax deductions in 2025 haven’t become more generous. They’ve become more exact.

Knowing whether you’re W-2 or 1099, understanding how tax-free stipends replace lost deductions, and keeping clean documentation matters more than ever. If your situation feels straightforward, great. If it feels confusing, that’s normal. Travel nurse taxes sit in a niche most general preparers don’t truly understand.

👉 Schedule a 15-Minute Stipend Review

Handled correctly, your tax strategy should feel boring, predictable, and defensible, not stressful or surprising.