Understanding Travel Nurse Tax Basics

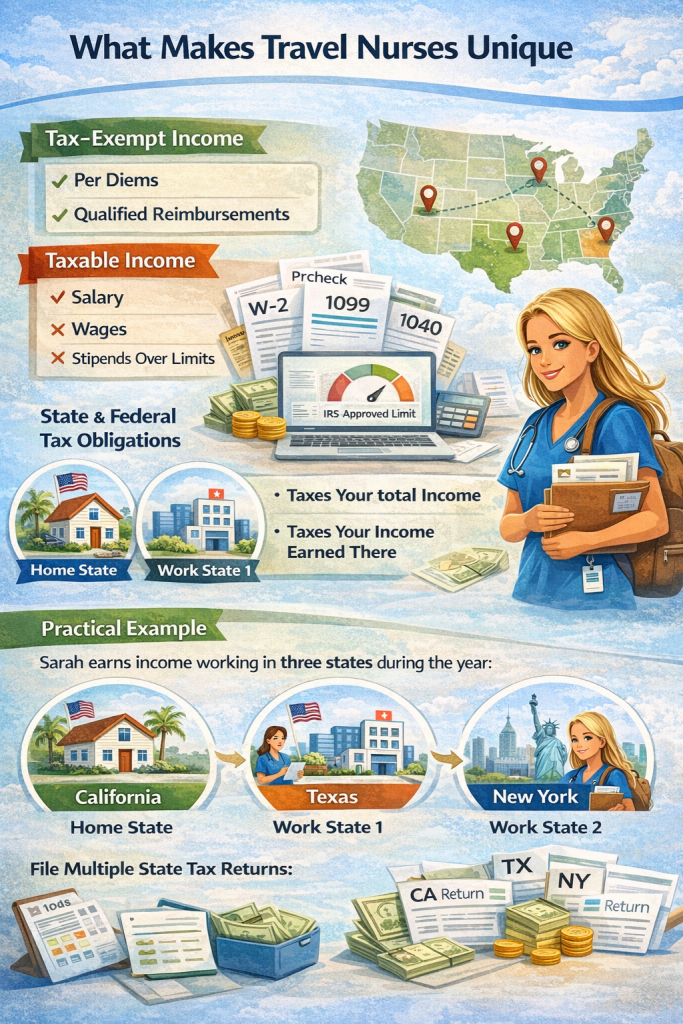

What Makes Travel Nurses Unique

Travel nurses, by their very nature, are a unique breed of healthcare professionals. Unlike traditional staff nurses who are tied to a single healthcare facility, travel nurses are nomads of the medical world, moving from one assignment to another, often across state lines. This mobility presents a unique set of tax challenges that require careful consideration and expert guidance.

Tax-Exempt vs. Taxable Income

One of the most critical aspects of travel nurse taxation is understanding the distinction between tax-exempt and taxable income. This distinction can significantly impact your overall tax liability.

- Tax-Exempt Income: This typically includes per diems and reimbursements for qualified business expenses such as meals, lodging, and travel. These amounts are not considered taxable income.

- Taxable Income: This includes your salary, wages, and any stipends that exceed the IRS-approved limits.

State and Federal Tax Obligations

As a travel nurse, you may have tax obligations in multiple states. Understanding these obligations is crucial to ensure accurate tax filing and avoid potential penalties.

- Home State: Your home state will typically tax your income, including any income earned in other states.

- Work State: Each state where you work may have its own income tax laws. You may need to file a non-resident tax return in these states, depending on the specific rules and regulations.

Tax Forms Travel Nurses Should Know

Several tax forms are relevant to travel nurses:

- W-2: This form reports your wages, salaries, and tips from your employer.

- 1099-MISC: This form reports non-employee compensation, such as stipends or bonuses.

- 1040: This is the primary federal income tax return form.

Practical Example

Let’s consider a scenario where a travel nurse, Sarah, works in three states during the year:

- Home State (California): Sarah’s permanent residence is in California. She will need to file a California state tax return, reporting all of her income, including income earned in other states.

- Work State 1 (Texas): Sarah works a 13-week assignment in Texas. She will need to file a non-resident Texas tax return, reporting her Texas-sourced income.

- Work State 2 (New York): Sarah works a 10-week assignment in New York. She will need to file a non-resident New York tax return, reporting her New York-sourced income.

In this scenario, Sarah will file three state tax returns: one for her home state of California and two for the states where she worked. She will also need to file a federal tax return, reporting all of her income on Form 1040.

Conclusion

Navigating the complex world of travel nurse taxes can be daunting. However, by understanding the fundamental concepts and seeking expert advice, you can ensure accurate tax filing and minimize your tax liability.