Managing Multistate Tax Filings

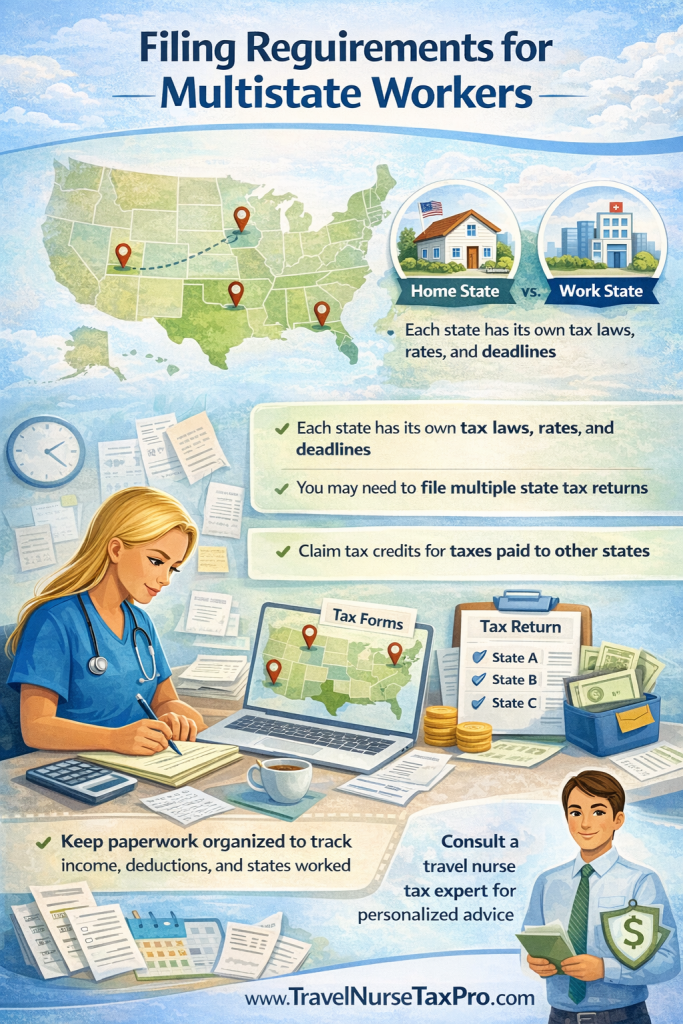

Filing Requirements for Multistate Workers

As a travel nurse, your mobility across state lines can significantly complicate your tax filing. Each state has its own income tax laws, rates, and filing deadlines. This means that you may need to file multiple state tax returns, depending on where you worked during the year.

Tax Credits for Taxes Paid to Other States

To prevent double taxation, you can claim credits on your home state tax return for taxes paid to other states. This reduces your overall tax liability. However, the specific rules and limitations for claiming these credits vary by state.

Home State vs. Work State

- Home State: Your home state is where you legally reside. It will typically tax all of your income, regardless of where it was earned.

- Work State: Each state where you work may have its own income tax laws. You may need to file a non-resident tax return in these states, reporting only the income earned within that state.

Rental Properties and Additional Filing Obligations

If you own rental properties in other states, you may have additional tax filing requirements. You’ll need to report rental income on your federal tax return and may need to file state tax returns in the states where the properties are located. State taxes on rental income can vary widely, so it’s important to understand the specific rules for each state.

Practical Example: California vs. Texas

Let’s compare the tax implications for a travel nurse working in California and Texas:

- California: Known for its high state income tax rates, California will tax all of your income, including income earned in other states. However, if you work in another state, you may be able to claim a credit for taxes paid to that state.

- Texas: As a state with no income tax, Texas won’t tax your income directly. However, you may still have other tax obligations, such as sales tax and property tax.

Conclusion

Managing multistate tax filings can be a complex task. To ensure accurate reporting and avoid potential penalties, it’s crucial to stay organized, understand the specific tax laws of each state, and consider seeking professional tax advice. By working with a tax professional who specializes in travel nurse taxes, you can simplify the process and maximize your tax savings.